Electric Vehicle Battery Market Size to Worth USD 661.98 Billion by 2034 Rising Demand for Clean and Affordable Electric Vehicles

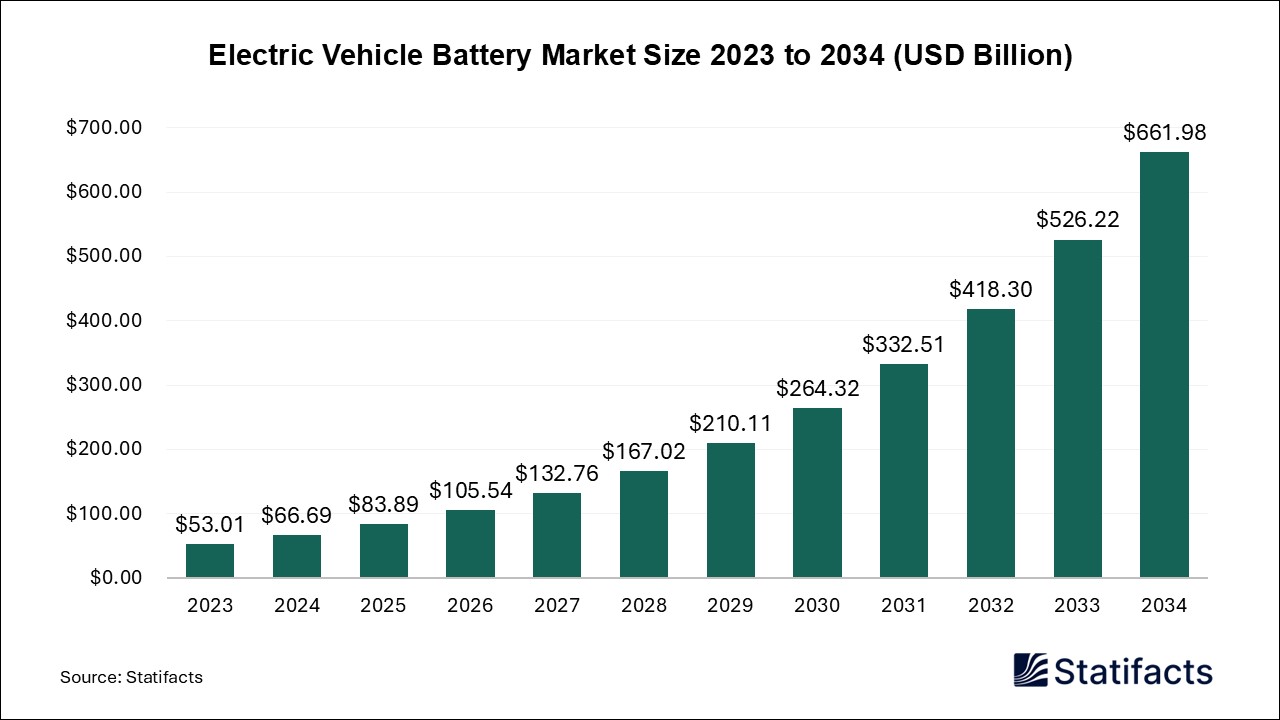

The global electric vehicle battery market size will soar from USD 66.69 billion in 2025 and is estimated to hit around USD 661.98 billion by 2034, registering a CAGR of 28.72% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Oct. 03, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global electric vehicle battery market size was valued at USD 53.01 billion in 2024 and is predicted to be worth around USD 661.98 billion by 2034, expanding at a CAGR of 28.72% from 2024 to 2034. High charging time with limited charging infrastructure, rising demand for premium electric vehicles, increasing inclination toward electric mobility, and rising need for lower-cost and clean transportation solutions are driving the growth of the market.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/6167

Electric Vehicle Battery Market Highlights

A notable development is Panasonic Energy’s USD 4 billion battery manufacturing facility in Kansas, which will deliver over 30 GWh annually by 2026. This project highlights North America’s growing capacity and compliance with the Inflation Reduction Act.

- North America led the market in 2024 and is expected to maintain its dominance with the fastest CAGR during the forecast period, driven by strong government support and EV adoption.

- Asia-Pacific saw notable growth in 2024 and is projected to strengthen its position, led by China’s leadership in EV production and battery manufacturing.

- Lithium-ion batteries dominated the market in 2024 and are set to remain the preferred choice for EVs due to their efficiency and cost reductions.

- BEVs held the largest market share in 2024 and will continue to grow as consumer demand and government incentives rise.

- HEVs are the fastest-growing segment, driven by their appeal as a transition technology in regions with limited EV infrastructure.

- Europe recorded significant growth in 2024 and is expected to continue expanding due to stricter emission regulations and rising demand for sustainable transportation.

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

What are the Recent Innovations Happening in Electric Vehicle Batteries?

The electric vehicle battery market refers to the production, distribution, and use of electric vehicle batteries, which are rechargeable and used to power the electric motors of Battery Electric Vehicles (BEV) or hybrid electric vehicles (HEV). An electric vehicle battery is a type of rechargeable battery that supplies electric energy to an electric vehicle. Energy storage systems, generally, batteries are essential for all-electric vehicles, plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles. The benefits of EV batteries include reduced wastage, energy efficiency, tax benefits, renewable energy integration, noise pollution reduction, home charging convenience, electric cars reduce emissions, easy to drive, decreased dependence on fossil fuels, zero emissions, lower operating costs, performance, environmental benefits, and cost savings.

In September 2025, the J3327 Surface Vehicle EV Battery Global Traceability standard, which it calls the first industry-wide framework designed to document and track the journey of critical minerals used in EV batteries, was introduced by SAE International. The standard covers the stages from extraction and manufacturing to use and end of life. J3327 is designed with international supply chain needs for compatibility, including the European Union’s Digital Product Passport and the International Organization for Standardization (ISO) protocols for batteries. Source: Charged EVS

Artificial intelligence (AI) has the potential to supercharge the discovery of complex battery materials and processes, allowing faster charging, improved sustainability, and higher energy density. The applications of AI turn electric vehicles into a fascinating consumer option, as it integrates autonomous driving and driver assistance systems, helps to integrate with the smart grid, promotes intelligent charging infrastructure, allows predictive maintenance, improves battery management, improves energy management & optimization, and facilitates EV charging.

What are the Major Government Initiatives and Policies for Electric Vehicle Batteries?

-

Production Linked Incentive (PLI) Scheme in India

India's PLI scheme for Advanced Chemistry Cell (ACC) Battery Storage aims to boost domestic battery manufacturing by allocating INR 181 billion (approximately USD 2.2 billion). The program targets a cumulative 50 GWh of domestic manufacturing capacity by 2025, with incentives tied to sales and domestic value addition.

-

Electric Mobility Promotion Scheme (EMPS) 2024 in India

The Indian government extended the EMPS 2024 until September 30, 2024, increasing its funding to INR 778 crore (USD 94 million). The scheme supports the adoption of electric two-wheelers and three-wheelers, with incentives focused on commercial and corporate use, promoting domestic manufacturing and job creation.

-

Green Deal Industrial Plan in the European Union

The EU's Green Deal Industrial Plan, introduced in 2023, includes provisions for faster permitting of battery production facilities and financial support for net-zero projects. The plan also proposes a Critical Raw Materials Act to ensure secure supply chains for essential minerals used in EV batteries.

-

Incentives for Local EV Production in South Africa

South Africa announced a 1-billion-rand (USD 54 million) investment to support local EV and battery production, aiming to transition the automotive industry by 2035. The initiative includes attracting original equipment manufacturers (OEMs) and implementing a regional critical minerals strategy.

-

Battery Passport Initiative by the U.S. National Institute of Standards and Technology (NIST)

The U.S. NIST is developing an EV Battery Passport to enhance transparency and traceability in the battery supply chain. The initiative aims to improve recycling, reduce environmental impact, and ensure the ethical sourcing of materials.

Key Market Trends

- Declining Battery Costs: The global average price of EV batteries has decreased from $153 per kWh in 2022 to $149 per kWh in 2023, with projections suggesting a further drop to $80 per kWh by 2026. This reduction is driven by advancements in manufacturing processes and economies of scale, making EVs more affordable and accelerating adoption.

- Shift Towards Lithium Iron Phosphate (LFP) Batteries: LFP batteries, which are less expensive and safer than traditional nickel-cobalt-manganese (NCM) batteries, are gaining popularity. In 2024, LFP batteries accounted for nearly half of the global EV battery market, with China leading this shift. However, adoption in the U.S. remains below 10%, partly due to existing tariffs on Chinese imports.

- Advancements in Solid-State Battery Technology: Solid-state batteries, utilizing a solid electrolyte instead of a liquid one, offer higher energy densities, faster charging times, and enhanced safety. Companies like Toyota, BMW, and Volkswagen are actively developing this technology, aiming for commercialization by 2025.

- Increased Demand for Battery Metals: The surge in EV production has led to a significant rise in the demand for critical minerals such as lithium, cobalt, and nickel. In 2023, battery demand for these metals reached approximately 140 kt for lithium, 150 kt for cobalt, and nearly 370 kt for nickel, accounting for substantial portions of global demand.

-

Integration of EV Batteries into Energy Storage Systems: EV batteries are increasingly being utilized in stationary energy storage applications, such as home and industrial battery storage systems. In Germany, for instance, the market for home storage systems grew by 52% in 2022, highlighting the expanding role of EV batteries beyond transportation.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/6167

Market Dynamics

Drivers

- Rising demand for premium electric vehicles: Rising demand for premium electric vehicles includes urbanization, more efficient, and smaller cars are generally more prevalent in urban areas, where the average daily driving distance is much shorter. The benefits of EVs provide to customers include trusted reliability, fun to drive, savings and incentives, environmental efficiency, and easy charging. Electrified vehicles are more efficient than gas-powered vehicles and can help reduce or eliminate driving emissions, and charge easily on the go at an ever-growing network of public charging stations.

- Stringent government regulations: The government offers different types of financial incentives to make electric vehicles more affordable for us. International Energy Agency policies promote electric vehicle deployment. The policy targets 25% electrification of vehicle sales in 2024 and 50% of all new buses to be battery electric. Factors like a rise in demand for stringent government rules and regulations toward vehicle emissions, along with a reduction in increasing fuel costs, low-emission, high-performance, and fuel-efficient vehicles, are supplementing the growth of the electric vehicle market in the state.

Restraint

-

Issues with battery safety: Issues with battery safety disadvantages include resale value, recharge points, charging station availability, range anxiety, limited selection, limited range, limited driving range, less infrastructure for charging points, expensive recharging options, EV climate control can reduce range, less infrastructure for charging points, expensive recharging options, EV climate control can reduce range, battery replacement, purchase cost, high upfront cost, environmental impact of battery production, battery degradation, charging speeds, and charging infrastructure.

Opportunity

-

Technological advancements:

Technological advancements in electric vehicle battery technology include those focusing on key areas that directly influence driving range and charging efficiency, which are two critical factors in the widespread adoption of EVs. Technological advancement plays an important role in improving the durability of electric vehicle batteries. Improved battery technology is leading to EVs with lower costs, longer ranges, and shorter charging times, making them more attractive to consumers. The transition of electric vehicle batteries lies in the development of more affordable, efficient, and durable batteries.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/6167

Electric Vehicle Battery Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 53.01 Billion | |

| Market Size in 2025 | USD 83.89 Billion | |

| Market Size in 2031 | USD 332.51 Billion | |

| Market Size by 2034 | USD 661.98 Billion | |

| CAGR 2025-2034 | 28.72% | |

| Leading Region in 2024 | Asia-Pacific | |

| Fastest Growing Region | North America | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | By Type, By Application, and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | CATL, Panasonic, LG Chem, BYD, Samsung SDI, Johnson Controls, GS Yuasa, Hitachi Group, Automotive Energy Supply, Blue Energy, Lithium Energy Japan, Bosch, Wanxiang, Beijing Pride Power, and Others. | |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Electric Vehicle Battery Market Segmentation

Type Insights

Which Type Dominates the Electric Vehicle Battery Market?

The lithium-ion battery segment held a dominant presence in the market in 2024 and is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. As compared to lead-acid batteries, lithium-ion batteries offer significant benefits, including longer lifespan, charge efficiency, improved discharge, and the ability to deep cycle while maintaining power. Lithium-ion batteries are the most widely used and reliable source of energy for electric vehicles. Lithium-ion batteries have higher energy densities than lead-acid batteries and nickel metal hydride batteries, making it possible to reduce their size while retaining the same storage capacity.

Application Insights

Which Application Leads the Electric Vehicle Battery Market in 2024?

The hybrid electric vehicles (HEVs) segment led the market in 2024. The benefits of hybrid electric vehicles (HEVs) include zero tailpipe emissions, need less maintenance, quiet operation, higher upfront cost, government incentives, cost savings, charging flexibility, performance, lower operating costs, hybrid cars are quiet, eco-friendly, reduced fossil fuel dependence, no range anxiety, higher resale value, drawbacks of hybrids, lower emissions, hybrid vehicles, environmental benefits, regenerative braking, and fuel efficiency.

The battery electric vehicles (BEVs) segment is projected to experience the highest growth rate in the market between 2025 and 2034. EV batteries are known for their higher energy efficiency compared to traditional internal combustion engines. Electric motors are inherently more efficient in converting stored energy into motion, resulting in reduced energy wastage. All forms of electric vehicles (EVs) can help to improve fuel economy, reduce emissions, and lower fuel costs. EV batteries are rechargeable and produce zero tailpipe emissions, making them a cleaner alternative to gasoline-based vehicles.

Regional Insights

Asia Pacific Electric Vehicle Battery Market

Asia Pacific dominated the global market in 2024 due to the limited charging infrastructure, high charging time, strong demand for premium electric vehicles, increasing inclination toward electric mobility, and rising need for clean and lower-cost transportation solutions in the Asia Pacific region. In May 2025, a new electric vehicle (EV) Assembly Operator Trade at its Skill and Entrepreneurship Development Institute (SEDI) in Bhatapara, Chhattisgarh, was launched by Ambuja Cements. Ambuja Cement’s Corporate Social Responsibility (CSR) aims to prepare the country's youth for the rapidly evolving electric mobility sector, equipping them with future-ready skills that align with the growing demand for green transportation across India. Source: Energetica India

China's dominance in the regional market is the result of a strategic combination of government policy, industrial infrastructure, and global supply chain control. China's government has implemented policies that promote EV adoption, such as subsidies for EV purchases, reduced license fees, and dedicated EV lanes in cities. These measures have incentivized domestic producers and fleet operators to adopt battery-powered vehicles, leading to increased demand for battery storage. Chinese companies manage the entire EV battery supply chain, from mining raw materials like lithium and cobalt to manufacturing battery cells and assembling final packs. This vertical integration enhances efficiency and cost-effectiveness, positioning companies like CATL, BYD, and CALB as global leaders in battery production.

North America Electric Vehicle Battery Market

North America is anticipated to grow at the fastest rate in the market during the forecast period because of the rapid investment in research and development (R&D) by BEV OEMs, strict government regulations to reduce carbon emissions, technological advancement in battery materials and designs, and increasing EV adoption in the North American region. In May 2025, the next step in the brand’s march toward the North American business plan, dubbed Momentum 2030, was confirmed by Mitsubishi Motors North America, Inc. This announcement confirmed that Mitsubishi Motors will work with its Alliance Partner, Nissan Motor Co., Ltd, to bring BEV to market in the United States and Canada. Source PR Newswire

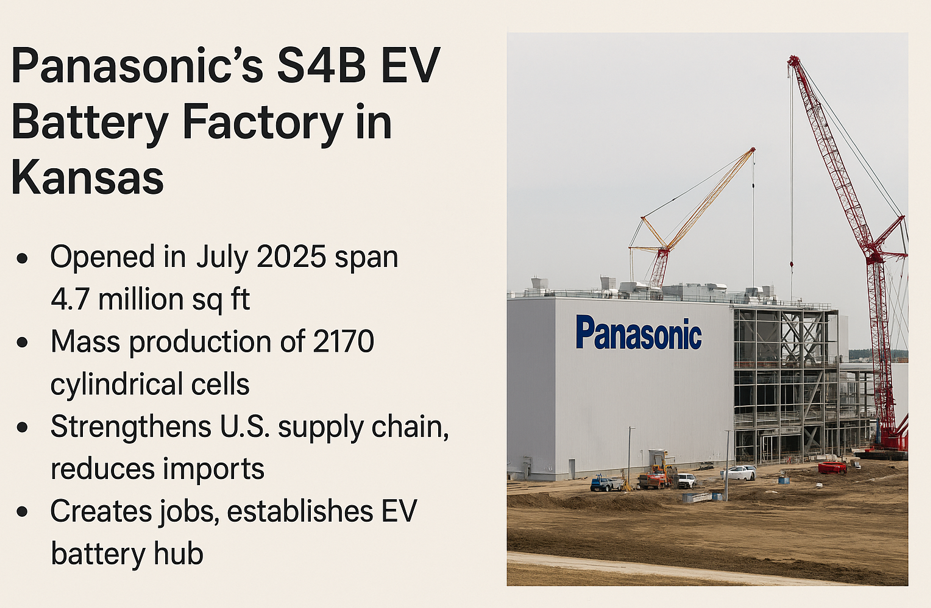

Case Study: Panasonic’s $4 Billion EV Battery Factory in Kansas

As the global electric vehicle (EV) battery market is projected to soar to USD 661.98 billion by 2034, North America is emerging as one of the fastest-growing regions, driven by strong government incentives, domestic manufacturing initiatives, and rising EV adoption. A key milestone in this trajectory is Panasonic Energy’s decision to invest heavily in the U.S. to localize EV battery production.

The Challenge

Historically, the U.S. has relied heavily on imported EV batteries, leaving the domestic market vulnerable to supply chain disruptions and cost fluctuations. With increasing EV demand and stringent policies like the Inflation Reduction Act, there was mounting pressure on manufacturers to scale production locally, reduce dependency on Asia, and create a sustainable supply chain for battery manufacturing.

The Initiative

In July 2025, Panasonic officially opened its $4 billion EV battery factory in De Soto, Kansas, spanning 4.7 million sq ft (roughly 225 football fields).

- The facility started mass production of 2170 cylindrical lithium-ion cells for EVs.

- It aims for an annual production capacity of 32 GWh once fully operational.

- The factory is expected to generate thousands of local jobs, boosting regional economic development.

This move directly supports automakers in meeting growing EV demand and aligns with U.S. policies encouraging domestic EV battery production.

Outcomes

- Supply Chain Strengthening: By producing batteries domestically, the U.S. reduces reliance on imports from Asia, creating a more resilient supply chain.

- Cost Competitiveness: Localized production helps lower logistics costs and mitigates tariff impacts, making EVs more affordable.

- Job Creation: Thousands of new positions are being created in Kansas, contributing to regional economic development.

- Industry Signal: Panasonic’s investment validates North America’s potential as a leading EV battery hub, encouraging similar moves by other global players.

Key Takeaways

- The case highlights how large-scale private investments, backed by favorable government policy, accelerate market growth.

- It demonstrates the real-world link between projected market expansion (as in your PR) and on-the-ground execution.

- It underscores the U.S.’s strategy to lead in clean energy technologies by building localized, sustainable, and future-ready EV battery infrastructure.

The U.S. is a major player in the regional market, due to a combination of strong government support, substantial investments in domestic manufacturing, and technological innovation. Policies like the Inflation Reduction Act have funneled billions into EV production and battery development, incentivizing companies to build large-scale battery plants within the country. Major automakers and battery manufacturers are forming strategic partnerships to boost production capacity and advance battery technology, focusing on improving energy density, reducing costs, and increasing sustainability. Additionally, expanding EV charging infrastructure is accelerating EV adoption, further driving demand for locally produced batteries.

Browse More Research Reports:

- The global solid-state battery pressure gauge market was valued at USD 52.05 million in 2024 and is projected to reach USD 88.91 million by 2034, growing at a CAGR of 5.5%.

- The global aviation power battery system market, valued at USD 195 million in 2024, is forecast to reach USD 383.59 million by 2034, growing at a 7% CAGR as the aviation industry adopts cleaner, more efficient energy solutions for aircraft and operations.

- The global battery electric vehicle (BEV) charging inlets market, valued at USD 411 million in 2024, is forecast to reach USD 1,334.65 million by 2034, growing at a 12.5% CAGR as demand for efficient, universal charging solutions for electric vehicles increases.

- The global specialty battery market size accounted for USD 99.4 billion in 2024 and is predicted to touch around USD 228.91 billion by 2034, growing at a CAGR of 8.69% from 2025 to 2034.

- The global high voltage battery market size was evaluated at USD 31,840 million in 2024 and is expected to grow around USD 5,11,320 million by 2034, registering a CAGR of 32% from 2025 to 2034.

- The global battery operated light market size is calculated at USD 122.95 billion in 2024 and is predicted to reach around USD 330.69 billion by 2034, expanding at a CAGR of 10.4% from 2024 to 2034.

- The absorbent glass mat (AGM) battery market size is predicted to gain around USD 20,420 million by 2034 from USD 12,650 million in 2024 with a CAGR of 9.3%.

- The stationary battery storage market size was estimated at USD 18,451 million in 2024 and is projected to be worth around USD 3,07,736 million by 2034, growing at a CAGR of 32.5%.

- The lithium and lithium ion battery electrolyte market size is predicted to gain around USD 16,863 million by 2034 from USD 5,286 million in 2024 at a CAGR of 12.3%.

- The global Silicon-Based Anode Material for Li-ion Battery Market set to surge from USD 525M in 2024 to USD 16,422.13M by 2034, with a 41.1% CAGR.

- The lead acid battery market size was valued at USD 62.90 billion in 2024 and is projected to reach USD 109.50 billion by 2034, at a CAGR of 5.7%.

- The global solar battery market size was exhibited at USD 185.79 million in 2024 and is predicted to reach around USD 778.2 million by 2034, at a CAGR of 15.4%.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/6167

Top Companies in the Electric Vehicle Battery Market

- CATL - CATL is a global leader in lithium-ion battery manufacturing, providing high-capacity and long-lasting battery solutions specifically designed for electric vehicles.

- Panasonic - Panasonic supplies advanced lithium-ion batteries known for their energy density and reliability, serving major EV manufacturers worldwide.

- LG Chem - LG Chem develops high-performance EV batteries that focus on safety, longevity, and rapid charging capabilities.

- BYD - BYD produces integrated electric vehicle batteries and powertrain systems, emphasizing sustainability and efficiency.

- Samsung SDI - Samsung SDI offers innovative battery technologies with enhanced energy density and safety features tailored for electric vehicles.

- Johnson Controls - Johnson Controls provides comprehensive battery systems and energy management solutions that optimize electric vehicle performance.

- GS Yuasa - GS Yuasa manufactures durable and efficient lithium-ion batteries, supporting electric mobility with reliable power sources.

- Hitachi Group - Hitachi develops advanced battery packs and energy storage systems focused on improving electric vehicle range and safety.

- Automotive Energy Supply - Automotive Energy Supply specializes in high-capacity lithium-ion batteries designed to meet the rigorous demands of EV applications.

- Blue Energy - Blue Energy focuses on developing sustainable and high-efficiency battery cells for electric vehicles.

- Lithium Energy Japan - Lithium Energy Japan produces cutting-edge lithium-ion battery technologies that prioritize performance and environmental safety.

- Bosch - Bosch delivers integrated battery solutions and electric drive components aimed at enhancing EV efficiency and reliability.

- Wanxiang - Wanxiang manufactures high-quality lithium-ion battery packs and modules designed for diverse electric vehicle applications.

- Beijing Pride Powder - Beijing Pride Powder specializes in producing advanced battery materials critical to enhancing the performance and durability of EV batteries.

The EV battery market is highly consolidated, with a few leading companies capturing the majority of global share, while several regional and niche players contribute smaller proportions.

1. Top Tier (Dominant Global Leaders – High Concentration)

These players collectively hold 70–75% of the global EV battery market share:

- CATL (China) – ~35–37% global share, the undisputed leader, supplying Tesla, BMW, Hyundai, and others.

- LG Chem / LG Energy Solution (South Korea) – ~15–17% global share, key supplier to GM, Hyundai, and Volkswagen.

- BYD (China) – ~15–16% global share, vertically integrated with its own EV production and battery supply.

- Panasonic (Japan) – ~7–8% global share, strongly tied to Tesla’s early growth but gradually diversifying.

2. Second Tier (Strong but Smaller Players – Moderate Concentration)

These players together contribute around 15–18% of the market:

- Samsung SDI (South Korea) – ~5–6% share, supplies BMW, Ford, and Stellantis.

- SK On (subsidiary of SK Innovation, not in your list but relevant) – ~5–6% share.

- GS Yuasa (Japan) – <2% share, strong in hybrid and niche applications.

- Hitachi Group – minor share, focused more on materials and industrial energy storage.

-

Wanxiang (China) – niche supplier, <2%.

3. Third Tier (Small or Regional Players – Low Concentration)

These collectively contribute 7–10% of the global market:

- Johnson Controls – transitioned battery business to Clarios, less active in pure EV segment.

- Automotive Energy Supply Corporation (AESC, Japan) – now Envision AESC, growing presence in Europe.

- Blue Energy (JV between Honda & GS Yuasa) – focused on hybrids, <1% global share.

- Lithium Energy Japan – small-scale, <1%.

- Beijing Pride Power (China) – state-backed, niche supplier.

- Bosch – exited large-scale EV battery manufacturing, focusing on components and battery management systems.

Market Concentration Insights

- Highly Concentrated Top 3: CATL, LG Chem, and BYD dominate, leaving limited room for others.

- Regional Fragmentation: Japan and South Korea players still relevant but losing ground to Chinese dominance.

-

Consolidation Trend: Many smaller players (Blue Energy, Lithium Energy Japan, Pride Power) are either niche-focused or in decline due to high R&D and production costs.

Overall Concentration Ratio (CR4 – Top 4 Players): ~75%

This means the top four (CATL, LG Chem, BYD, Panasonic) control nearly three-quarters of the global EV battery market.

Recent Developments

- In September 2025, a new reverse logistics solution dedicated to the transport, storage, and processing of end-of-life electric vehicle (EV) batteries was announced by CEVA Logistics, a global leader in third-party logistics and leading finished vehicle logistics (FVL) player in Europe. In recent years, as the electric and hybrid vehicle market has steadily grown, nearly 8 million lithium-ion batteries are expected to reach end-of-life in Europe over the next five years. Source: CEVA Logistics

- In July 2025, the lithium-ion battery factory for electric vehicles in De Soto, Kansas, which has started mass production of 2170 cylindrical lithium-ion cells at the plant, was officially opened by Panasonic Energy Co. The company is aiming for an annual production capacity of nearly 32 GWh in Kansas once the plant is fully operational. Source: Automotive Dive

Segments Covered in the Report

By Type

- Lead-acid Batteries

- Lithium Battery

- Others

By Application

- BEV

- HEV

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Explore More Reports:

- Vitamin D Market - https://www.statifacts.com/outlook/vitamin-d-market

- Bamboo Flooring Market - https://www.statifacts.com/outlook/bamboo-flooring-market

- Spine Biologics Market - https://www.statifacts.com/outlook/spine-biologics-market

- Membrane Oxygenator Market - https://www.statifacts.com/outlook/membrane-oxygenator-market

- Hydrazine Hydrate Market - https://www.statifacts.com/outlook/hydrazine-hydrate-market

- Chelants Market - https://www.statifacts.com/outlook/chelants-market

- Cricket Equipment Market - https://www.statifacts.com/outlook/cricket-equipment-market

- Wafer-Level Vacuum Laminator Market - https://www.statifacts.com/outlook/wafer-level-vacuum-laminator-market

- Quantum Encryption Communication Modules Market - https://www.statifacts.com/outlook/quantum-encryption-communication-modules-market

- Automotive Copper Core Cable Market - https://www.statifacts.com/outlook/automotive-copper-core-cable-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.